Ichimoku Kinko Hyo (IKH) or in short Ichimoku is a useful and very informative technical indicator. His name is in Japanese and means "balanced look at the outline." The idea behind this is that you will get everything you need to know about the state of the market with just one look at a chart containing this indicator.

The Ichimoku indicator performs several important tasks, namely:

Indicates the prevailing trend; shows the momentum and strength of the trend; provides reliable support and resistance levels; gives trading signals.

At first, this indicator may sound scary, but when you recognize it well, you will find it very simple and invaluable in terms of market analysis.

In this course, we will share with you the elements of Ichimoku and the signals it provides. We will also explain how to analyze the market using this technical tool.

Elements and components of Ichimoku

This indicator relies heavily on moving averages that are subject to adjustments. His lines have traditional Japanese names as well as contemporary names.

The Ichimoku indicator performs several important tasks, namely:

Indicates the prevailing trend; shows the momentum and strength of the trend; provides reliable support and resistance levels; gives trading signals.

At first, this indicator may sound scary, but when you recognize it well, you will find it very simple and invaluable in terms of market analysis.

In this course, we will share with you the elements of Ichimoku and the signals it provides. We will also explain how to analyze the market using this technical tool.

Elements and components of Ichimoku

This indicator relies heavily on moving averages that are subject to adjustments. His lines have traditional Japanese names as well as contemporary names.

Take a look at the Ichimoku index on the chart. We can distinguish 3 layers - past, present, and future.

Let's start with the so-called "present". It is a layer characterized by two lines - Cajun and Tenkan. Among them, Cajun (baseline) is a moving average with a larger period of time. Thus, it measures the medium-term momentum and has more weight than Tinkan. The price intersects with Tinkan usually more than Cajun, and if the price crosses with Cajun, it indicates changes in the market.

The future is the Ichimoku cloud. The cloud consists of two moving averages being pushed forward. If the SMA (Cinco Span B) is lower than the SMA (Cinco Span A), the cloud is considered bullish. The color is usually light. If Cinco Span B is higher than Cinco Span A, the cloud is considered to be bearish. This cloud often has a darker color. Bullish clouds indicate that buyers dominate the market, while bearish clouds indicate that sellers are in control. You can see that the color of the cloud changes from time to time to reflect control shifts from bulls to bears and vice versa. The width of the cloud is important: the broader the downward cloud, the stronger the sellers. To understand the current balance of power in the market, look at the "future" cloud portion, that is to the right of the current price. As for the part of the cloud, which is in line with current prices, it serves as support and price resistance.

In the "past", there is one line called Shinko Span. Unlike other Ichimoku lines, it is not a moving average, but simply a price on the chart that has moved in a number of time periods backwards so that it lags behind the market. The way this line interacts with the price chart itself offers hints for traders.

Why are some elements of the pointer pushed forward, while others are positioned in the back? First, it is very difficult to read the chart if all five lines are in the same area. In addition, the elements of the Ichimoku index in this way are able to generate trading signals. This course will show you how to interpret these signals.

The future is the Ichimoku cloud. The cloud consists of two moving averages being pushed forward. If the SMA (Cinco Span B) is lower than the SMA (Cinco Span A), the cloud is considered bullish. The color is usually light. If Cinco Span B is higher than Cinco Span A, the cloud is considered to be bearish. This cloud often has a darker color. Bullish clouds indicate that buyers dominate the market, while bearish clouds indicate that sellers are in control. You can see that the color of the cloud changes from time to time to reflect control shifts from bulls to bears and vice versa. The width of the cloud is important: the broader the downward cloud, the stronger the sellers. To understand the current balance of power in the market, look at the "future" cloud portion, that is to the right of the current price. As for the part of the cloud, which is in line with current prices, it serves as support and price resistance.

In the "past", there is one line called Shinko Span. Unlike other Ichimoku lines, it is not a moving average, but simply a price on the chart that has moved in a number of time periods backwards so that it lags behind the market. The way this line interacts with the price chart itself offers hints for traders.

Why are some elements of the pointer pushed forward, while others are positioned in the back? First, it is very difficult to read the chart if all five lines are in the same area. In addition, the elements of the Ichimoku index in this way are able to generate trading signals. This course will show you how to interpret these signals.

How to apply the Ichimoku index

To apply the Ichimoku index on the chart in MetaTrader. Click "Insert", choose "Pointers", then "Custom", then "Ichimoku". In the settings, you can choose the values of Tinkan, Cajun, and Cinco Span B. You can also modify the colors of cursor lines according to your desire.

To apply the Ichimoku index on the chart in MetaTrader. Click "Insert", choose "Pointers", then "Custom", then "Ichimoku". In the settings, you can choose the values of Tinkan, Cajun, and Cinco Span B. You can also modify the colors of cursor lines according to your desire.

The default settings 9.26-52 are the original parameters suggested by the cursor developer. They are very popular among traders and can be used on any time frame. At the same time, you have absolute freedom to adjust your settings. The most important thing is to choose the incremental values so that Tinkan Sen is the smallest and Cinco Span B is the largest.

Trading using the Ichimoku index

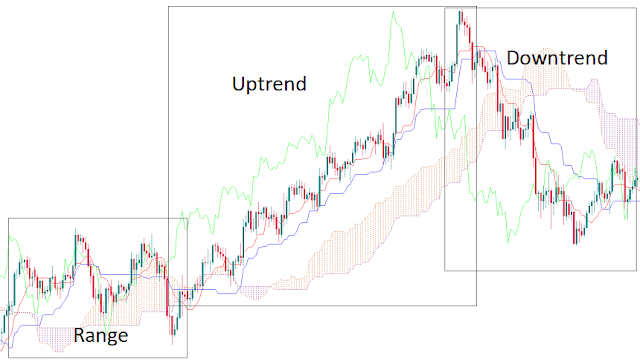

Ichimoku line sites give traders a clear view of current trends. When the market is sideways, the indicator lines are horizontal so that the price fluctuates around them. The cloud is thin and discolored a lot.

If the price is higher than the cloud, and Tinkan, Kijun and the rising cloud are strong and clear, the trend is up. The Shinko Span is higher than the price in this case.

If the price is lower than the cloud, and Tinkan, Cajun and the falling cloud are strong and clear, the trend is down. The Shinko Span is lower than the price in this case.

Trading using the Ichimoku index

Ichimoku line sites give traders a clear view of current trends. When the market is sideways, the indicator lines are horizontal so that the price fluctuates around them. The cloud is thin and discolored a lot.

If the price is higher than the cloud, and Tinkan, Kijun and the rising cloud are strong and clear, the trend is up. The Shinko Span is higher than the price in this case.

If the price is lower than the cloud, and Tinkan, Cajun and the falling cloud are strong and clear, the trend is down. The Shinko Span is lower than the price in this case.

Ichimoku lines generate trading signals by intersecting each other and with the price, so you find many different trading signals in the table below. Note that when a new trend starts, signals from cursor elements tend to appear at about the same time indicating one direction.

Let's look at an example of how to generate the Ichimoku Trading Signals Index.

1. The price fell below Cajun Sen. It is considered the first bearish signal.

2. Tinkan Sen dropped to below Kijun Sen.

3. Shinko Span broke the price chart downwards.

4. The price fell below the Ichimoku cloud.

5. The cloud turned from upward to downward.

Signals 2-4 appeared around the same time, indicating the beginning of a downtrend. This means an opportunity to open a short position. Indicator lines then acted as price resistance levels.

6. Shinko Span is back on the price chart. Profit can be taken from a short-term trade.

7. The price rose above Cajun Sen.

8. Tinkan Sen rose above Kijun Sen.

9. The thick Ichimoku cloud acted as a price resistance level but finally managed to penetrate it.

10. The cloud turned from a bearish to a bullish. The price rose above the cloud. There are signs of bullish formation, although the Shinko Span correction on the price chart may point to a side trend that will last for some time.

Conclusion

2. Tinkan Sen dropped to below Kijun Sen.

3. Shinko Span broke the price chart downwards.

4. The price fell below the Ichimoku cloud.

5. The cloud turned from upward to downward.

Signals 2-4 appeared around the same time, indicating the beginning of a downtrend. This means an opportunity to open a short position. Indicator lines then acted as price resistance levels.

6. Shinko Span is back on the price chart. Profit can be taken from a short-term trade.

7. The price rose above Cajun Sen.

8. Tinkan Sen rose above Kijun Sen.

9. The thick Ichimoku cloud acted as a price resistance level but finally managed to penetrate it.

10. The cloud turned from a bearish to a bullish. The price rose above the cloud. There are signs of bullish formation, although the Shinko Span correction on the price chart may point to a side trend that will last for some time.

Conclusion

The Ichimoku Index is an integrated trading system that can be used alone in trading. You can use it to identify the trend, find support and resistance levels, and get entry signals. You can modify the indicator settings and use it in parallel with other technical analysis tools.

ليست هناك تعليقات:

إرسال تعليق